Introduction to Andorra, its History and Taxes.

Andorra is a small European country located between France and Spain, known for its picturesque mountainous landscapes and ski resorts. It has a population of around 77,000 and is primarily known for its tourism industry. Andorra is also a tax haven, making it an attractive destination for many investors and entrepreneurs.

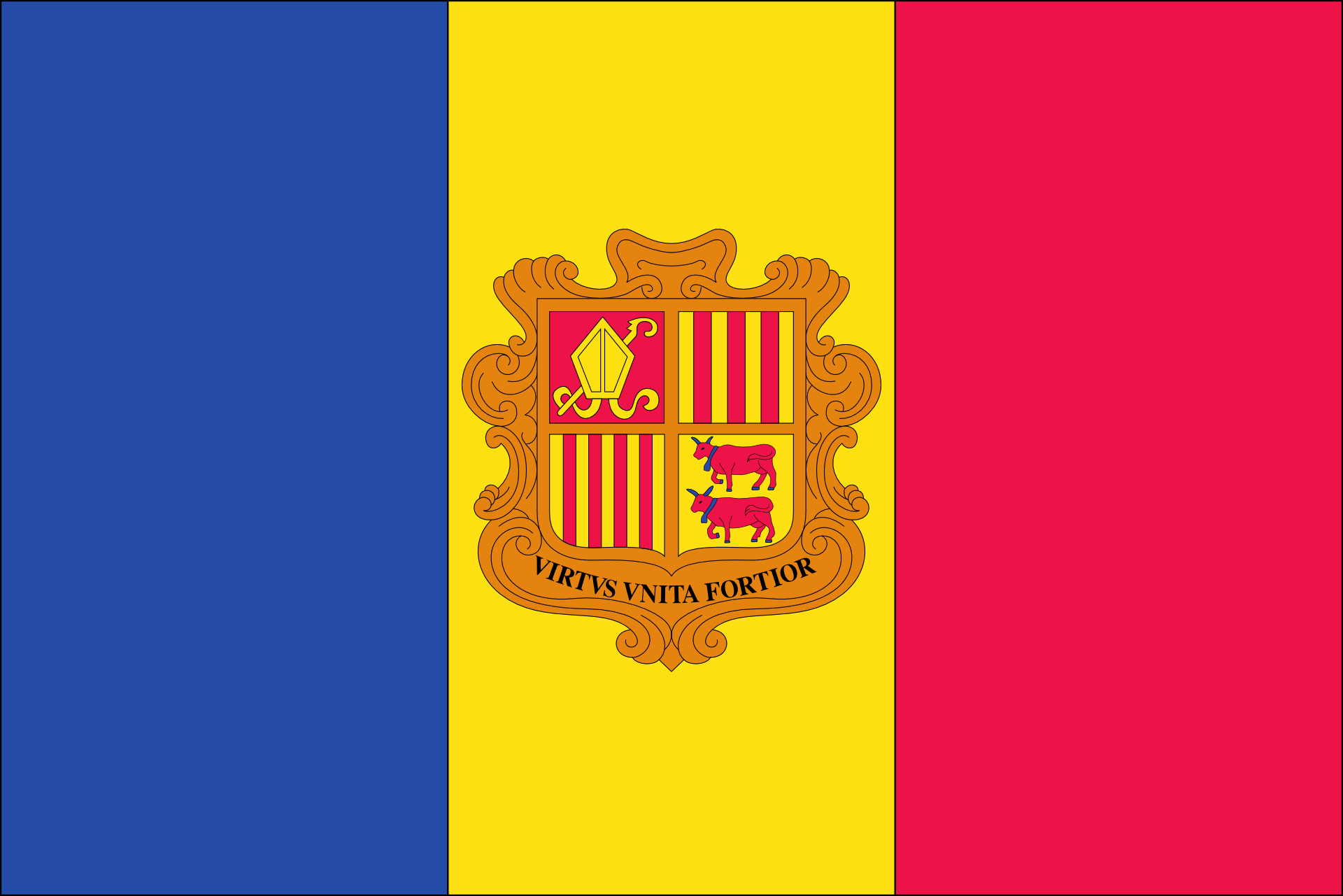

The country has a unique political system, with two co-princes serving as its heads of state. One of these co-princes is the President of France, while the other is the Bishop of Urgell in Catalonia, Spain. It has been an independent state since 1278 and has maintained its sovereignty through the centuries despite several attempts by neighboring countries to annex it.

Personal Taxes in Andorra

Andorra does not have any personal income tax, wealth tax, or inheritance tax. This makes it an attractive destination for individuals looking to lower their tax burden. However, residents are required to pay a communal tax, which varies depending on the region in which they live. This tax is used to fund local infrastructure and public services.

Non-residents are not subject to this tax, but they are required to pay a non-resident income tax if they earn any income in the country. The non-resident income tax rate is 10% and applies to all income earned in Andorra, including rental income and capital gains.

Business Taxes in Andorra

Ithas a relatively low corporate tax rate of 10%. This rate applies to all companies operating in the country, whether they are resident or non-resident. However, Andorra has a territorial tax system, which means that companies are only taxed on income earned within the country. This makes it an attractive destination for businesses with international operations.

There is also a value-added tax (VAT) in Andorra, which is set at a standard rate of 4.5%. This rate is lower than many other European countries, making it an attractive destination for businesses looking to sell their products or services in the European market.

Other Taxes in Andorra

In addition to personal and business taxes, there are a few other taxes in Andorra. These include:

- Property tax: This tax is levied on the value of real estate owned in Andorra. The rate varies depending on the location of the property and ranges from 0.2% to 0.5%.

- Vehicle tax: This tax is levied on the value of vehicles registered in Andorra. The rate ranges from 4% to 7%, depending on the age and type of the vehicle.

- Capital gains tax: Andorra does not have a separate capital gains tax, but capital gains are subject to the corporate tax rate of 10%.

Conclusion

Andorra’s tax system is relatively simple, with no personal income tax or wealth tax. The country’s low corporate tax rate and territorial tax system make it an attractive destination for businesses looking to expand their international operations. The country’s unique political system, picturesque landscapes, and tourism industry also make it an attractive destination for investors and entrepreneurs looking to establish a presence in Europe.